Hello traders!

If you follow me on twitter then you have probably seen me post many charts and setups.

Some of them were tweeted out and mentioned as an

'AOT TOP PICK'

So what exactly is an

'AoT TOP PICK' you ask?

Great question!

Well, in a nutshell, almost every evening, i email

'ART OF TRADING' members a 'NEW Setups' watchlist of stock setups. Each 'NEW Setups' watchlist contains about 2-4 stocks(on average) to watch very closely the next 1-2 days!

These stocks are VERY carefully selected after spending several hours of scanning/charting/research for the

"HIGHEST QUALITY" setups i am able to find in my "master watchlist"(usually from my

'Power Earnings Gap' watchlist. These are very selectively chosen stocks that have the "HIGHEST probability" of exploding higher or breaking out(imminent breakouts). I also provide an 'ideal entry" price for entry(the trigger price), if when a stock triggers, AOT members are alerted in the @AOTtrades and also via email and SMS that a trade has triggered!

The entry prices are very carefully chosen to take advantage of specific setups!

From this small nightly list 2-4 stock setups, I pick out what i think is the single "BEST OF THE BEST" idea if you will....

That's the 'AOT TOP PICK' !!

So only the "TOP OF THE TOP" will qualify as an 'AOT TOP PICK' !!

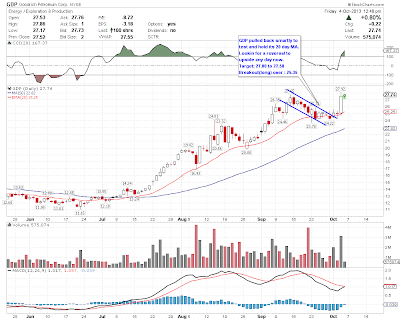

Below you'll see the UPDATED charts of this week's 'AOT TOP PICKS' that triggered entries and how they worked out for ART OF TRADING members shortly after triggering!

For the first week of October 2013 there was a total of 8 'AOT TOP PICKS' that triggered entries.

Here are the charts!

Here are some other names that stood out from the AoT watchlists this week but were not AoT "TOP PICKS"

Some feedback recieved this week from AoT members

Hey Stewie,

You da man! Just letting you know after yesterday's action in the overall market and all this chop and slop with DC involved, I took it nice and easy today and only took 3 setups: CIEN, DANG and UBNT.

I bot em right at the breakout levels, peeled 1/2 off when up $1, then booked my 2/3 on UBNT at $37. Still have 1/3 on UBNT and will hold DANG.

Already booked on 2 and paid for my AoT membership for 6 months. Well done and thanks a million.

I have actually been following you in the public domain and studying your charts since 2010 or so, I think, and love your style and your awesome charts. I'm so glad to be a member now.

Thanks again, and have a great weekend. And stay off that ankle!

Walter (Brand new AOT member , started this week!!)

Stewie,

Great 4 days for me as I started with your service Tuesday and plan to subscribe for the long term. Made money every day.... Not looking to get rich but don't want to go back to a 9 to 5 job either.

Thanks for the great trades and being a great guy. Good guys sometimes do finish first.

Have a great weekend.

Michael W. (Brand new AOT member , started 2 weeks ago!!)

Thanks for all the great setups this week! Followed you in MHR and KKD. I played CIEN today, entered at 26.02 , sold out at $27.

Mike S.

As always, if you have any questions, comments, feedback etc, email me or tweet me !

I'm always willing and really enjoy helping!

Join The 'ART OF TRADING' Today!